Are you tired of spending hours on tedious payroll tasks and manual data entry?

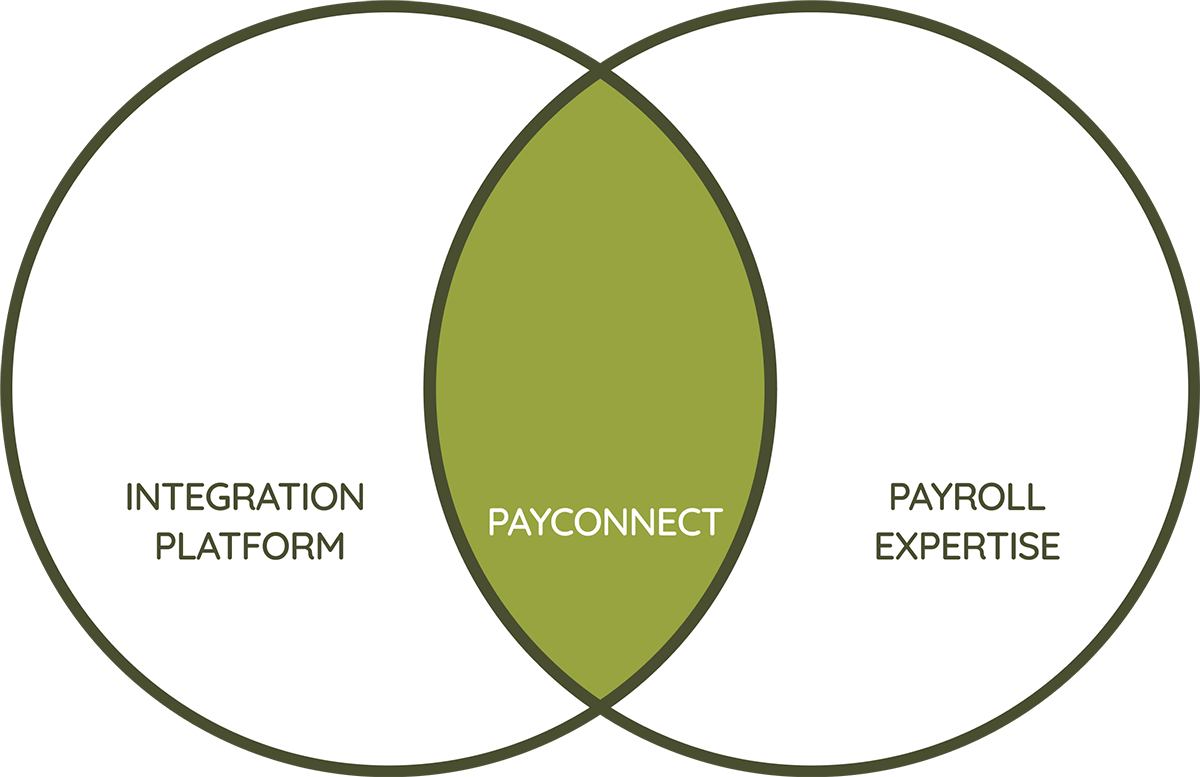

Try Nanoputian’s PayConnect, Our integrated payroll services is the ultimate solution to simplify and automate your payroll process, empowering your business with seamless efficiency and accuracy. PayConnect’s solutions integrate with all major payroll providers. With connectivity to more than 1400 software platforms we have your payroll ecosystem covered. Connect your SaaS or legacy solution with ease. Some of our popular connecters are: