Just like technology has transformed the way we carry out our day-to-day activities like shopping or socializing, it has also influenced the financial industry, including banking and mortgage. In the last few years, we have witnessed a significant growth of fintech startup companies leveraging technology to assist people in investments, get loans, and make payments.

It is quite convenient for people to carry out their financial activities the same way they socialize or apply for a job, i.e., with their phones or laptop. But that is not the only reason that contributes to the rise of fintech in India. If you think about why is fintech growing, it is due to the integration of big data and technology that enables different companies to acquire and analyze information in new ways.

What are Fintech Startups

Financial Technology or Fintech are those companies that use software such as web or mobile applications to offer financial services. Fintech startups were incepted to disrupt the existing conventional financial methods and compete with those larger financial organizations that don’t use technology much. Soon after the arrival of fintech startups, the larger firms have rapidly recognized the need for financial software solutions and working to implement Fintech to enhance their services and maintain their position in the market.

Reasons behind the Rise of Fintech Startups

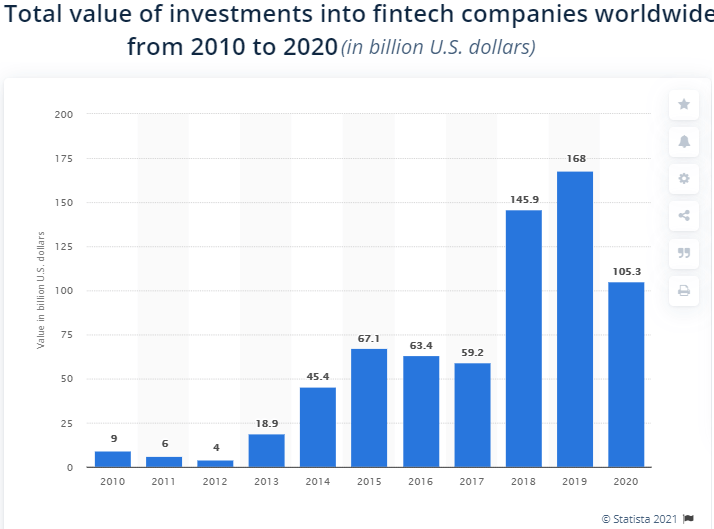

Financial tech industry has gained momentous significance in the past few years, and its global investment has touched the skies. Currently, Fintech makes up a multi-billion dollar industry, dominated by startups providing high-tech solutions to financial products and services.

Source: Statista

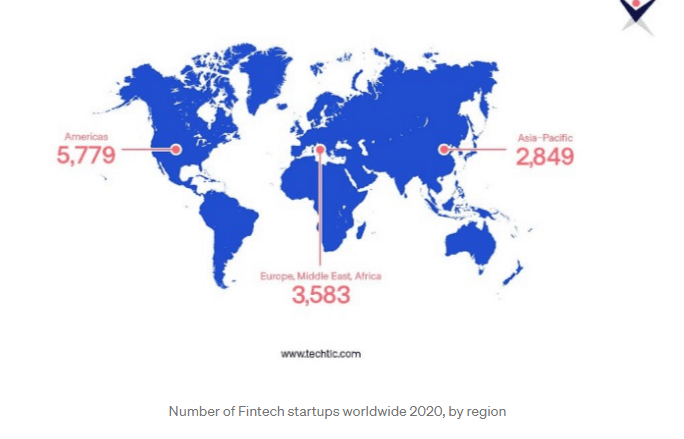

Source: Techtic Solutions

The question here arises is that what are the factors behind its success?

-

- Leveled Financial Playing Field for Everyone

One of the most considerable contributions Fintech has given to the financial industry is that it has leveled the financial playing field for everyone, irrespective of their wealth. Previously only wealthy individuals had access to some financial services like investment or underwriting. Integration of data and technology in Fintech makes it much cheaper and convenient to bring investment advice to the masses.

Similarly, underwriters didn’t have enough data to assess risk, so many people could not benefit from this service, or their risk assessment wasn’t accurate. With the help of technology, the fintech startups rely on a new set of data that wasn’t available to traditional banks. In this way, more people get access to business and personal capital and more accurate risk assessments—all of which couldn’t have been possible without technology, software, and data scientists. The use of technology and AI helps provide and store data, whereas there are various chatbots offering communication services.

-

- Mobile Payments

Who doesn’t love convenience? Mobile Payments are truly a blessing for people, offering them flexibility and convenience, unlike traditional payment methods. All they need to do is take out their phone to pay their bills without worrying about missing the deadline or send their friends and family money without going through any complex process.

Looking at the growing demand and convenience of mobile payments, there are so many options available for mobile payment providers these days. It includes payment processors like PayPal and Square, digital wallets like Google Wallet, MobiKwik, and Apple Pay, or money transfer services like Transferwire. They all focus on offering digital solutions for payment.

The mobile payment options are not limited to the front-end but also at the back-end as well. Fintech is allowing websites to power their payment features by letting them partner up with a payment processor.

-

- Student Loans and Online Lending

When banks failed to lend students loans, Fintech came up with innovative ways to meet the demand and perform effective risk assessments. Due to the absence of lenders, people opt for online lending for their student loan refinancing. Multiple fintech startups offer everything from refinancing existing student loans to originating new loans. But that’s not it; Fintech companies are also offering repayment assistance to the people to help them pay off their loans.

-

- Personal Savings

Fintech is eliminating the need to put your savings into a bank. People are reluctant to keep their money in banks, and they keep it with them at their house, increasing the risk for theft. But multiple fintech startups offer the service for personal financing or savings. They not only help people with saving money but offer rewards if they do so, motivating them to save more for rainy days.

-

- Insurance

Insurance is something that people despise but still have to do it. It has a long and tiring process and a lot of complexities that make the whole process arduous. Nevertheless, Fintech is offering assistance in the field of insurance as well. It not only makes the process easy but also reduces the cost while enhancing customer service.

Transformation of Traditional Financial Corporations to Fintech

Although the traditional financial firms are late to the Financial tech party, they keep up with the pace by shifting towards digital methods. Many of them have created their own online services, and others have partnered up with fintech companies to offer services to their customers. This has resulted in even more options for people instead of just opting for fintech startups. As per fintech growth statistics, around 77% of traditional financial organizations plan to enhance their focus on innovations leveraging technology.

All of this has accumulated considerable changes in the financial industry, which offers massive benefits to people of all financial backgrounds and economic statuses.

Fintech Statistics 2021

Here are some statistics that show why fintech is growing significantly day by day:

- 7% share of bank executives believes that Financial tech will impact wallets and mobile payments worldwide. – Statista

- Fintech grants a 38% share of U.S personal loans. – Statista

- Latin America’s financial tech market will exceed $150bn this year. – FinTech Global

- Google Pay, Samsung Pay, and Apple Pay will own 56% of the combined market share of mobile payments this year. – Juniper Research.

Final Thoughts

If you are thinking to fintech startup ideas, there are several things that you must consider. Firstly, choose wisely from the pool of choices. Nowadays, there are many options available that can make things overwhelming. You need to choose the one who has the staying power and doesn’t overcharge for their service. Another thing to consider before choosing them is that whether the company has proper regulatory oversight. Once all the boxes are checked, you can select them as your financial service provider and enjoy financing from anywhere at any time.

Other Related Articles You Might Be Interested In

Top Fintech App Ideas for Startups

Everything You Need to Know to Build an MVP for Your Startups

How to Choose Tech Stack for Startup